Inflation in the Eurozone Slows Down, Easing Pressure on the ECB

In the recent data published by Eurostat, it's evident that inflation within the Eurozone is slowing down. This trend offers some relief for the European Central Bank (ECB) which can now reassess its aggressive interest rate hikes—the fastest ever seen in its history.

To delve deeper, the Eurozone's inflation was pegged at 5.3% in July, marking a marginal decline from June's 5.5%. To put this into perspective, just a year ago, inflation surged to an alarming 8.9%.

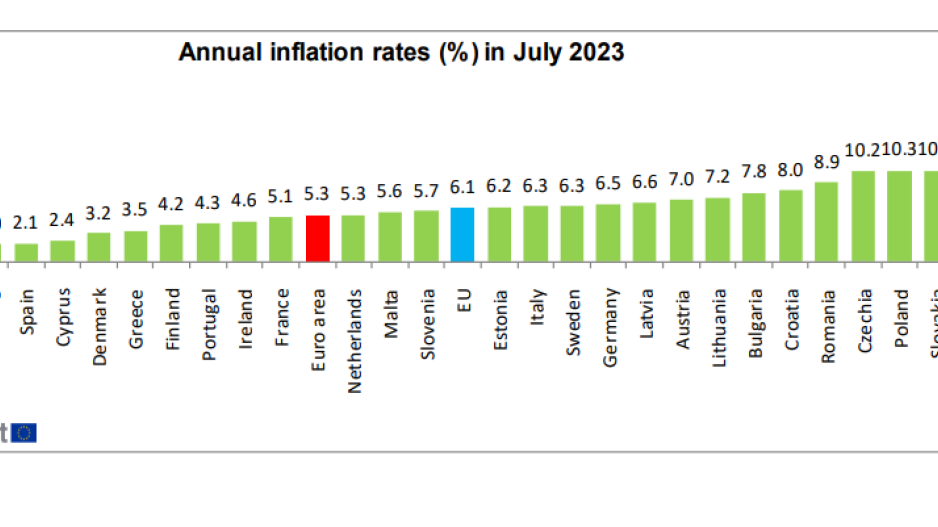

The collective annual inflation rate of the European Union for July 2023 stood at 6.1%, a slight drop from June's 6.4%. In comparison, the rate was a high 9.8% in the same month the previous year. An essential benchmark for the ECB is the inflation figure that excludes volatile elements such as food and energy prices. According to Eurostat's initial data, this core inflation metric remained consistent at 5.5%.

A geographical breakdown reveals that Belgium had the lowest annual inflation at 1.7%, followed by Luxembourg at 2.0% and Spain at 2.1%. Greece wasn't far behind, posting the sixth lowest rate at 3.5%. On the opposite end of the spectrum, Hungary recorded an inflation rate of 17.5%, with Slovakia and Poland both registering 10.3%.

To sum up the broader trend, nineteen EU member states experienced a dip in inflation, one saw no change, and seven reported an increase.