95% of NFTs Now Worthless, Birkenstock's $9.2B IPO Launch, And Ireland's First Influencer Degree

Today's Top Business & Finance Stories Around the Globe

The World Bank has revised down its growth outlook for East Asia and the Pacific region, warning that economies in the area are set to expand at one of their slowest paces in the past fifty years. Factors cited for this revision include a sluggish China and weak global demand amidst persistently high-interest rates and trade slowdowns.

As reported, the World Bank stated in its October report released today, that it anticipates economies in East Asia and the Pacific to grow by 5% in 2023. This is a slight dip from its earlier projection of 5.1% made in April. For 2024, the Washington-based bank now expects a growth rate of 4.5% for the region, down from its previous 4.8% forecast in April.

Moreover, the World Bank maintained its economic growth forecast for China in 2023 at 5.1%. However, it has reduced its estimate for 2024 to 4.4%, down from 4.8% earlier. The organization pinpointed "long-term structural factors," increased debt levels in the world's second-largest economy, and weaknesses in its real estate sector as reasons for the downgrade.

"While domestic factors are likely to be the dominant influence on growth in China, external factors will have a more pronounced impact on growth in much of the rest of the region," noted the World Bank.

Despite the economies of East Asia largely rebounding from a series of shocks since 2020 - including the Covid-19 pandemic - and set to continue growing, the World Bank expressed that the pace of growth will likely decelerate.

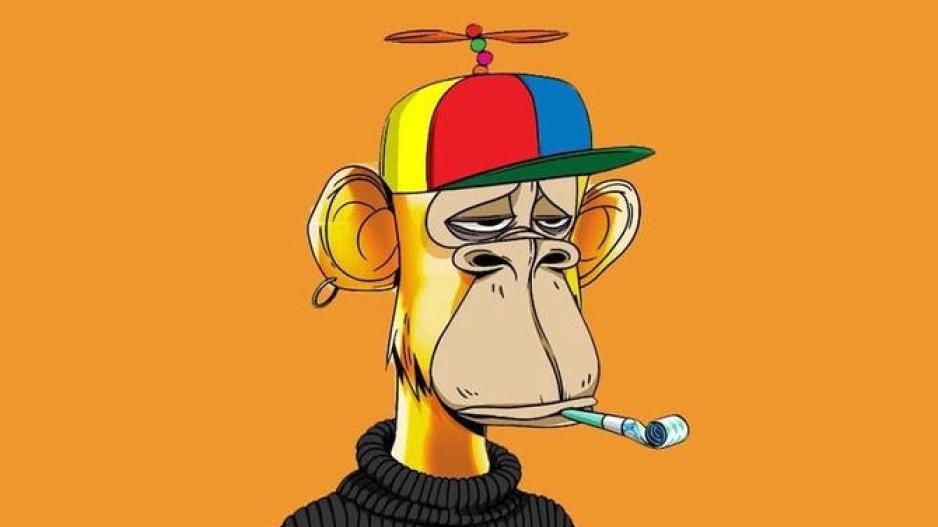

A recent study released by the cryptocurrency and gambling platform, dappGambl, has shed light on the grim reality facing the Non-Fungible Tokens (NFT) market. The hype surrounding NFTs seems to have significantly waned. Findings suggest that a staggering 95% of these digital assets now hold virtually no value. This revelation is particularly shocking when considering the heights that NFTs once reached. Backed in part by the meteoric rise of cryptocurrencies in 2021, NFTs had become the talk of the town, with transactions amounting to nearly $2.8 billion in August of that year alone.

Historically, NFTs once held a prime position in many crypto portfolios. However, their trajectory starkly contrasts with the more renowned cryptocurrencies. While Bitcoin and Ethereum have managed to maintain stable prices, NFTs have seen their transaction volume plummet, currently standing at a mere $80 million weekly. This dramatic drop is emphasized by dappGambl's exhaustive analysis of 73,257 NFT collections. Out of these, 69,795 collections have a combined value of zero ETH (with 1 ETH equivalent to about $1,600 as of today). Essentially, most NFTs are now worthless. Moreover, the study indicates that a whopping 79% of NFT collections possess vast amounts of tokens without any owners, highlighting a clear mismatch between supply and demand. According to the data made public, only about 1% of NFTs surpass a value of $6,000. Roughly two years after the phenomenon's peak, interest in NFTs seems lower than ever.

For those unfamiliar with the term, NFTs are digital items rooted in blockchain technology. They are primarily used for the acquisition of digital art pieces, be it paintings, photographs, or videos. These digital artifacts can be legally owned, with proof of ownership provided. However, it's essential to understand that despite having verified ownership, these digital files can easily be circulated online.

Birkenstock, the esteemed German footwear brand, backed by the private equity firm L Catterton, announced on Monday its aim to secure a valuation of up to $9.2 billion in its much-anticipated initial public offering (IPO) in New York.

The company intends to offer roughly 32.26 million shares, priced between $44 and $49 each, in the upcoming IPO. If successful, this would raise around $1.58 billion, according to filings with the U.S. Securities and Exchange Commission. This move comes despite mixed performances from three recently listed companies in September, overshadowing the revitalized investor appetite for new listings.

Interestingly, the U.S. securities regulatory body is now well-equipped, having avoided a government shutdown, enabling it to reassess IPO submissions from companies eager to capitalize on the renewed interest in public registrations.

Historically, Birkenstock's hallmark has been comfort over fashion. As stated on their website, every element of their design – from buckles and straps to soles and footbeds – serves a "functional purpose". However, in recent weeks, the brand has gained traction among fashion enthusiasts, especially after its footwear was featured in the box office hit "Barbie", worn by actress Margot Robbie in a pink hue.

With roots tracing back to 1774, Birkenstock is a sixth-generation family business. Most of its products are crafted in facilities located in Rhineland-Palatinate, North Rhine-Westphalia, Essen, and Saxony in Germany.

Goldman Sachs, J.P. Morgan, and Morgan Stanley are among the underwriters for the public offering.

A study by Capital Economics reveals that artificial intelligence will significantly augment economic growth in the United States and other developed economies, outpacing its influence in China and emerging economies. This surge will intensify global rivalry between Washington and Beijing.

The research ranked countries based on their potential to benefit from AI. Topping the list was the US, followed closely by Singapore, the United Kingdom, and Switzerland. China found its place around the middle of the 33-nation list. Despite its strong innovative prowess and substantial investments in AI, China's stringent regulatory approach could impede the rapid adoption of AI technologies, the report suggests.

China also faces challenges due to US restrictions on the export of microchips vital for AI processing. This implies that "China's AI ecosystem will likely evolve independently from the West," the report states.

However, the report further notes that the broader adoption of AI might "accentuate a global trend observed for some time: a deceleration in the rate at which emerging market incomes are converging with developed world incomes, especially when compared to the 'golden era' of the 2000s and early 2010s."

This sentiment resonates with findings by economists at Standard Chartered, emphasizing AI's potential to widen the developmental gap between advanced economies and emerging markets. Analysts at Goldman Sachs Group predicted in March that "creative AI" could lead to a dramatic boost in US productivity by approximately 1.5 percentage points annually over a decade, thus substantially augmenting global growth.

Capital Economics also pointed out potential impediments for India, where AI could hinder short-term growth. This is partly attributed to a slowdown in outsourcing of business processes from developed nations. The "gradual decline" of this sector could trim India's economic growth by 0.3 to 0.4 percentage points annually over the next decade.

When one observes today's most renowned influencers, it's evident that many either pursued academic fields unrelated to social media or gleaned insights merely from the "school of life". But change is on the horizon.

A university in Ireland is pioneering a fresh perspective in the sector by offering the country's first degree tailored for influencers. Come November, aspiring students can apply for the 'Bachelor of Arts in Content Creation and Social Media' at the Southeast Technical University in Carlow County. The inaugural cohort will commence their studies in September 2024.

The four-year degree encompasses a diverse curriculum, covering areas like business acumen, video and audio editing, cultural studies, and creative writing. In an interview with Ireland's RTÉ radio and television station, Dr. Eleanor O’Leary, a Media and Communication lecturer at the university, expressed the growing interest in this particular field, from both potential students and employers.

Dr. O'Leary emphasized that graduates will be aptly prepared to either work independently as self-employed influencers or collaborate with companies in content creation. Since 2019, the global worth of the influencer sector has doubled, currently valued between 14 and 16 billion euros, she informed RTÉ.

"This is a field that commands a specific set of skills," Dr. O'Leary said. "It draws from existing media, public relations, and marketing expertise but is also a unique domain in its own right."

While some might stumble upon influencer stardom almost by accident, the degree aims to impart knowledge on how students can sustain an audience and collaborate with businesses to monetize their influence effectively.